In order to reach the plan to stop selling fuel vehicles by 2035, European countries provide incentives for new energy vehicles in two directions: on the one hand, tax incentives or tax exemptions, and on the other hand, subsidies or funding for supporting facilities at the purchasing end or in the use of the vehicle. The European Union, as the core organisation of the European economy, has introduced policies to guide the development of new energy vehicles in each of its 27 member states. Austria, Cyprus, France, Greece, Italy and other countries directly in the purchase of the link to give cash subsidies, Belgium, Bulgaria, Denmark, Finland, Latvia, Slovakia, Sweden, seven countries do not provide any purchase and use of incentives, but to provide some tax incentives.

The following are the corresponding policies for each country:

Austria

1.Commercial zero-emission vehicles VAT relief, calculated according to the total price of the vehicle (including 20% VAT and pollution tax): ≤ 40,000 euros full VAT deduction; the total purchase price of 40,000-80,000 euros, the first 40,000 euros without VAT; > 80,000 euros, do not enjoy the benefits of VAT relief.

2. Zero-emission vehicles for personal use are exempt from ownership tax and pollution tax.

3. Corporate use of zero-emission vehicles is exempted from ownership tax and pollution tax and enjoys a 10% discount; corporate employees using company zero-emission vehicles are exempted from charging tax.

4. By the end of 2023, individual users who buy pure electric range ≥ 60km and total price ≤ 60,000 euros can get 3,000 euros incentive for pure electric or fuel cell models, and 1,250 euros incentive for plug-in hybrid or extended range models.

5. Users who purchase before the end of 2023 can enjoy the following basic facilities: 600 euros of smart loading cables, 600 euros of wall-mounted charging boxes (single/double dwellings), 900 euros of wall-mounted charging boxes (residential areas), and 1,800 euros of wall-mounted charging piles (integrated devices used as load management in comprehensive dwellings). The latter three depend mainly on the residential environment.

Belgium

1. Pure electric and fuel cell vehicles enjoy the lowest tax rate (EUR 61.50) in Brussels and Wallonia, and pure electric vehicles are exempted from tax in Flanders.

2. Individual users of pure electric and fuel cell vehicles in Brussels and Wallonia enjoy the lowest tax rate of 85.27 euros per year, Wallonia does not levy taxes on the purchase of the above two types of vehicles, and the tax on electricity has been reduced from 21 per cent to 6 per cent.

3. Corporate buyers in Flanders and Wallonia are also eligible for the Brussels tax incentives for purely electric and fuel cell vehicles.

4. For corporate buyers, the highest level of relief is applied to models with CO2 emissions ≤ 50g per kilometre and power ≥ 50Wh/kg under NEDC conditions.

Bulgaria

1. Only electric vehicles tax-free

Croatia

1. Electric vehicles are not subject to consumption tax and special environmental taxes.

2. The purchase of pure electric car subsidies 9,291 euros, plug-in hybrid models 9,309 euros, only one application opportunity per year, each car must be used for more than two years.

Cyprus

1. Personal use of cars with CO2 emissions of less than 120g per kilometre is exempt from tax.

2. Replacement of cars with CO2 emissions of less than 50g per kilometre and costing no more than €80,000 can be subsidised up to €12,000, up to €19,000 for purely electric cars, and a €1,000 subsidy is also available for scrapping old cars.

Czech Republic

1. Pure electric vehicles or fuel cell vehicles that emit less than 50g of carbon dioxide per kilometre are exempted from registration fees and have special licence plates attached.

2.Personal users: pure electric vehicles and hybrid models are exempted from road tax; vehicles with CO2 emissions of less than 50g per kilometre are exempted from road tolls; and the depreciation period of electric vehicle charging equipment is shortened from 10 years to 5 years.

3.Tax reduction of 0.5-1% for BEV and PHEV models for private use of corporate nature, and road tax reduction for some fuel-vehicle replacement models.

Denmark

1.Zero-emission vehicles are subject to a 40% registration tax, minus DKK 165,000 registration tax, and DKK 900 per kWh of battery capacity (up to 45kWh).

2. Low-emission vehicles (emissions <50g CO2/km) are subject to a 55 per cent registration tax, less DKK 47,500 registration tax, and DKK 900 per kWh of battery capacity (up to a maximum of 45kWh).

3. Individual users of zero-emission cars and cars with CO2 emissions of up to 58g CO2/km benefit from the lowest half-yearly tax rate of DKK 370.

Finland

1.From 1 October 2021, zero-emission passenger cars are exempt from registration tax.

2.Corporate vehicles are exempted from tax charges of 170 euros per month for BEV models from 2021 to 2025, and charging electric vehicles at the workplace is exempted from income tax.

France

1.Electric, hybrid, CNG, LPG and E85 models are exempted from all or 50 per cent of tax charges, and models with pure electric, fuel cell and plug-in hybrids (with a range of 50km or more) are massively tax-reduced.

2.Enterprise vehicles that emit less than 60g of carbon dioxide per kilometre (except diesel vehicles) are exempt from the carbon dioxide tax.

3.The purchase of pure electric vehicles or fuel cell vehicles, if the vehicle selling price does not exceed 47,000 euros, individual user family subsidies of 5,000 euros, corporate users subsidies of 3,000 euros, if it is a replacement, can be based on the value of the vehicle subsidies, up to 6,000 euros.

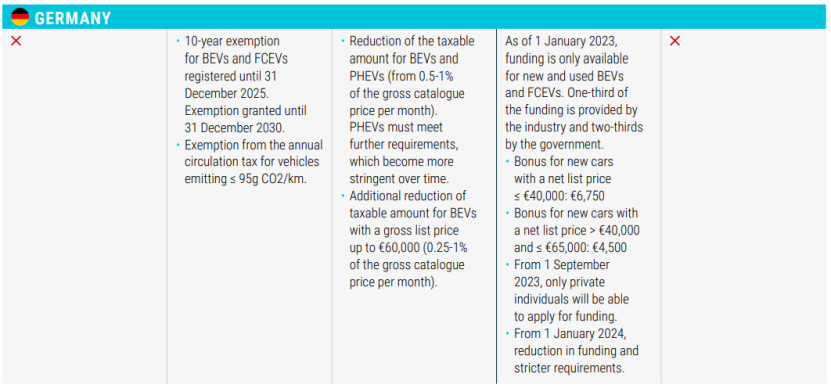

Germany

1.Pure electric vehicles and hydrogen fuel cell vehicles registered before 31 December 2025 will receive a 10-year tax relief until 31 December 2030.

2.Exempt vehicles with CO2 emissions ≤95g/km from annual circulation tax.

3.Reduce income tax for BEV and PHEV models.

4.For the purchasing segment, new vehicles priced below €40,000 (inclusive) will receive a €6,750 subsidy, and new vehicles priced between €40,000 and €65,000 (inclusive) will receive a subsidy of €4,500, which will only be available to individual purchasers as of 1 September 2023, and as of 1 January 2024, the declaration will be more stringent.

Greece

1. 75% reduction in registration tax for PHEVs with CO2 emissions up to 50g/km; 50% reduction in registration tax for HEVs and PHEVs with CO2 emissions ≥ 50g /km.

2.HEV models with displacement ≤1549cc registered before 31 October 2010 are exempted from circulation tax, while HEVs with displacement ≥1550cc are subject to 60% circulation tax; cars with CO2 emissions ≤90g/km (NEDC) or 122g/km (WLTP) are exempted from circulation tax.

3. BEV and PHEV models with CO2 emissions ≤ 50g/km (NEDC or WLTP) and net retail price ≤ 40,000 euros are exempted from the preferential class tax.

4.For the purchase of the link, pure electric vehicles enjoy 30% of the net selling price of the cash rebate, the upper limit is 8,000 euros, if the end-of-life of more than 10 years, or the age of the buyer is more than 29 years old, you need to pay an additional 1,000 euros; pure electric taxi enjoys 40% of the net selling price of the cash rebate, the upper limit of 17,500 euros, the scrapping of old taxis need to pay an additional 5,000 euros.

Hungary

1. BEVs and PHEVs are eligible for tax exemption.

2. From 15 June 2020, the total price of 32,000 euros of electric vehicles subsidies 7,350 euros, selling price between 32,000 to 44,000 euros subsidies of 1,500 euros.

Ireland

1. 5,000 euro reduction for pure electric vehicles with a selling price of not more than 40,000 euro, over 50,000 euro is not entitled to the reduction policy.

2. No NOx tax is levied on electric vehicles.

3.For individual users, the minimum rate of pure electric vehicles (120 euros per year), CO2 emissions ≤ 50g /km PHEV models, reduce the rate (140 euros per year).

Italy

1. For individual users, pure electric vehicles are exempted from tax for 5 years from the date of first use, and after the expiry of this period, 25% of the tax on equivalent petrol vehicles applies; HEV models are subject to a minimum tax rate (€2.58/kW).

2.For the purchase segment, BEV and PHEV models with a price ≤35,000 euros (including VAT) and CO2 emissions ≤20g/km are subsidised by 3,000 euros; BEV and PHEV models with a price ≤45,000 euros (including VAT) and CO2 emissions between 21 and 60g/km are subsidised by 2,000 euros;

3. Local customers receive an 80 per cent discount on the purchase and installation price of the infrastructure provided for charging electric vehicles, up to a maximum of 1,500 euros.

Latvia

1.BEV models are exempted from the first registration registration fee and enjoy a minimum tax of 10 euros.

Luxembourg 1. Only 50% administrative tax is levied on electric vehicles.

2.For individual users, zero-emission vehicles enjoy the lowest rate of EUR 30 per year.

3. For corporate vehicles, a monthly subsidy of 0.5-1.8% depending on CO2 emissions.

4. For the purchase of the link, BEV models with more than 18kWh (including) subsidy of 8,000 euros, 18kWh subsidy of 3,000 euros; PHEV models per kilometre of carbon dioxide emissions ≤ 50g subsidy of 2,500 euros.

Malta

1. For individual users, vehicles with CO2 emissions ≤100g per kilometre enjoy the lowest tax rate.

2. The purchase of the link, pure electric models personal subsidies between 11,000 euros and 20,000 euros.

Netherlands

1. For individual users, zero-emission vehicles are exempt from tax, and PHEV vehicles are subject to 50% tariff.

2. Corporate users, 16% minimum tax rate for zero-emission vehicles, the maximum tax for pure electric vehicles is not more than 30,000 euros, and there is no restriction on fuel cell vehicles.

Poland

1.No tax on pure electric vehicles, and no tax on PHEVs under 2000cc by the end of 2029.

2.For individual and corporate buyers, a subsidy of up to PLN 27,000 is available for pure EV models and fuel cell vehicles purchased within PLN 225,000.

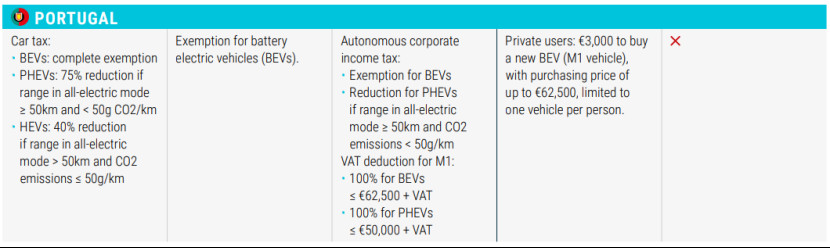

Portugal

1.BEV models are exempted from tax; PHEV models with pure electric range ≥50km and CO2 emissions <50g/km are given a tax reduction of 75%; HEV models with pure electric range >50km and CO2 emissions ≤50g/km are given a tax reduction of 40%.

2. Private users to buy M1 category pure electric vehicles maximum price of 62,500 euros, subsidies of 3,000 euros, limited to one.

Slovakia

1. Pure electric vehicles are exempt from tax, while fuel cell vehicles and hybrid vehicles are subject to a 50 per cent levy.

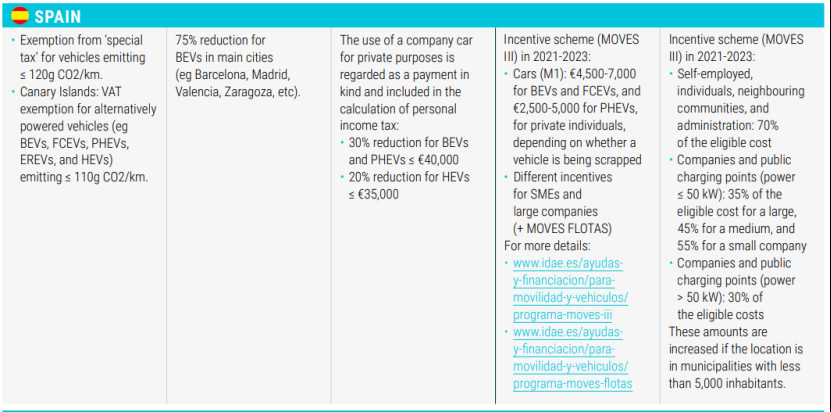

Spain

1. Exemption from "special tax" for vehicles with CO2 emissions ≤ 120g/km, and exemption from VAT in the Canary Islands for alternatively-powered vehicles (e.g. bevs, fcevs, phevs, EREVs and hevs) with CO2 emissions ≤ 110g/km.

2. For individual users, a 75 per cent tax reduction on pure electric vehicles in major cities such as Barcelona, Madrid, Valencia and Zaragoza.

3. For corporate users, BEVs and PHEVs priced at less than 40,000 euros (inclusive) are subject to a 30% reduction in personal income tax; HEVs priced at less than 35,000 euros (inclusive) are subject to a 20% reduction.

Sweden

1. Lower road tax (SEK 360) for zero-emission vehicles and PHEVs among individual users.

2. 50 per cent tax reduction (up to SEK 15,000) for home EV charging boxes, and a $1 billion subsidy for the installation of AC charging equipment for apartment building residents.

Iceland

1. VAT reduction and exemption for BEV and HEV models at the point of purchase, no VAT on retail price up to 36,000 euros, full VAT on top of that.

2. VAT exemption for charging stations and installation of charging stations.

Switzerland

1. Electric vehicles are exempt from car tax.

2. For individual and corporate users, each canton reduces or exempts transport tax for a certain period of time based on fuel consumption (CO2/km).

United Kingdom

1. Reduced tax rate for electric vehicles and vehicles with CO2 emissions below 75 g/km.

Post time: Jul-24-2023